What Are ICOs?

ICOs or Initial Coin Offerings are basically crowd sales, the cryptocurrency version of crowdfunding. The ICOs have been truly revolutionary and have managed to accomplish to amazing tasks:

- They have provided the simplest path by which DAPP developers can get the required funding for their project.

- Anyone can become invested in a project they are interested in by purchasing the tokens of that particular DAPP and become a part of the project themselves. (We are talking about Work Tokens here).

So, how does an ICO work?

Firstly, the developer issues a limited amount of tokens. By keeping a limited amount of tokens they are ensuring that the tokens itself have a value and the ICO has a goal to aim for. The tokens can either have a static pre-determined price or it may increase or decrease depending on how the crowd sale is going.

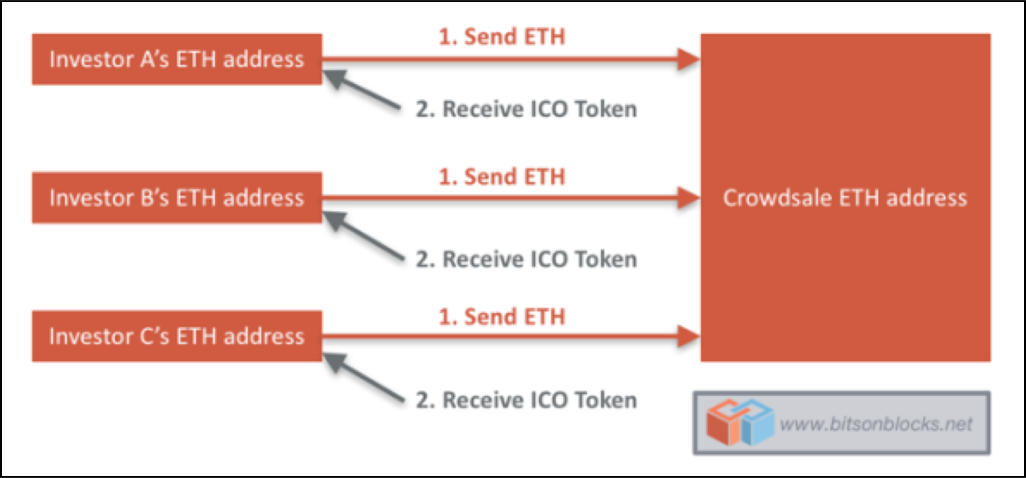

The transaction is a pretty simple one. If someone wants to buy the tokens they send a particular amount of ether to the crowd sale address. When the contract acknowledges that this transaction is done, they receive their corresponding amount of tokens. Since everything on Ethereum is decentralized, an ICO is considered a success if it is properly well-distributed and a majority of its chunk is not owned by one entity.

The DAO ($150 million) was the biggest ICO of all time until it was recently overtaken by Bancor ($152 million).

How Does An Ethereum Token Get Its Value?

Now that we know how you can get your hands on you tokens, let`s find out what gives them their value in the first place. Tokens get their value from the same place that most things get their value. They are mainly two factors:

- Supply & Demand.

- Trust

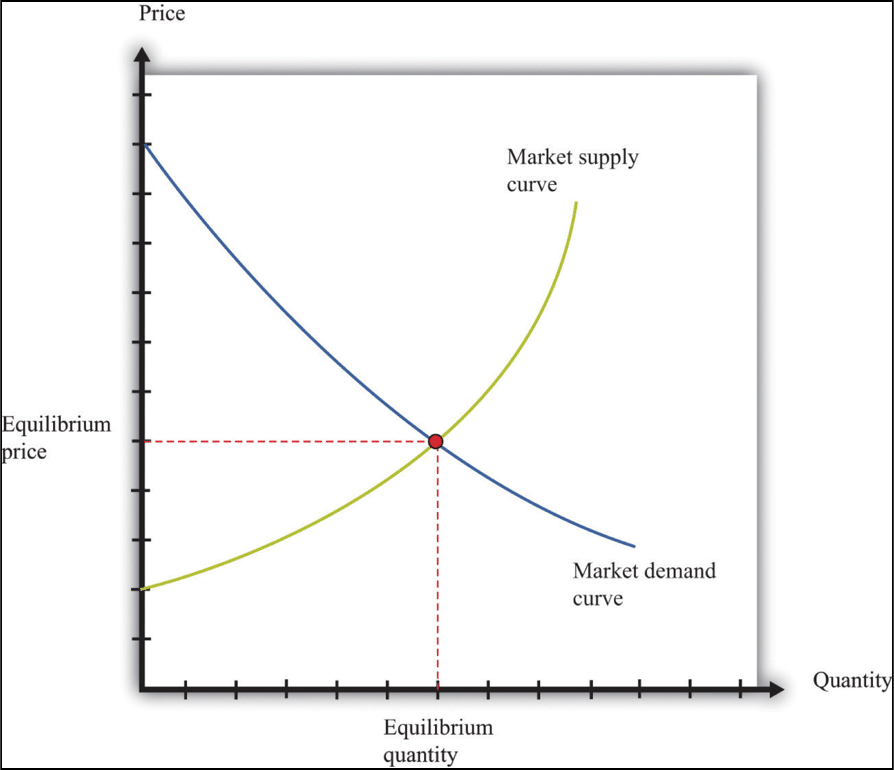

Supply & Demand: This is basic economics 101. More the demand and lesser the supply more will be the price of the product. The supply-demand graph looks sorta like this:

There is a fixed amount of tokens that can be issued in the first place. Each and every token is accounted for because like ether, token transactions are also recorded in the open ledger. If in case the developer wants to change the number of tokens issued, then they will have to create a new application. Any code that is issued in the blockchain is irreversible so the old application cannot be changed in any way.

So, now that we have a fixed and finite amount of tokens, that takes care of the `supply` part. What about the demand? The demand obviously depends on a lot of factors. What is the quality of DAPP in itself? Are people excited about the DAPP? Has that DAPP been marketed properly? Is that DAPP going to solve problems? If the demand of the DAPP is sufficiently high, and with the supply remaining constant, it goes without saying that the value of the token is going to be pretty high.

Trust: Like with any currency, tokens will only have value if people have trust in it. Trust comes from a lot of sources like the credibility of the developers, the kind of service provided by the DAPP etc